US–China Pause Trade War for Another 90 Days – What It Means for Law Firms 🇺🇸🇨🇳

📢 What happened?

After several rounds of intense trade talks and mounting economic pressure at home, the United States and China have agreed to extend their trade truce for a further 90-days.

The existing 30% levy on Chinese imports and 10% tariffs on American goods will remain in place, but no new ones will be introduced during this time.

This move aims to give the parties more space to devise long-term agreements on current disputes over trade, technology, and market access.

📈 Global markets reacted instantly to this move. Stock indices across Europe and Asia hit record highs, and businesses breathed a sigh of relief as global trade tensions eased.

💡 Why does it matter?

The US and China are the world’s two biggest economies. When they’re in a trade war, prices go up globally, supply chains get complicated, and all businesses feel the pressure – including UK companies.

This extra 90-day pause gives companies a rare moment of stability. They know that costs and trade conditions won’t change for the next three months. That’s enough to give them the confidence to act, providing:

- 🕒 A stable window to lock in deals (mergers, acquisitions, major contracts) before tensions flare again.

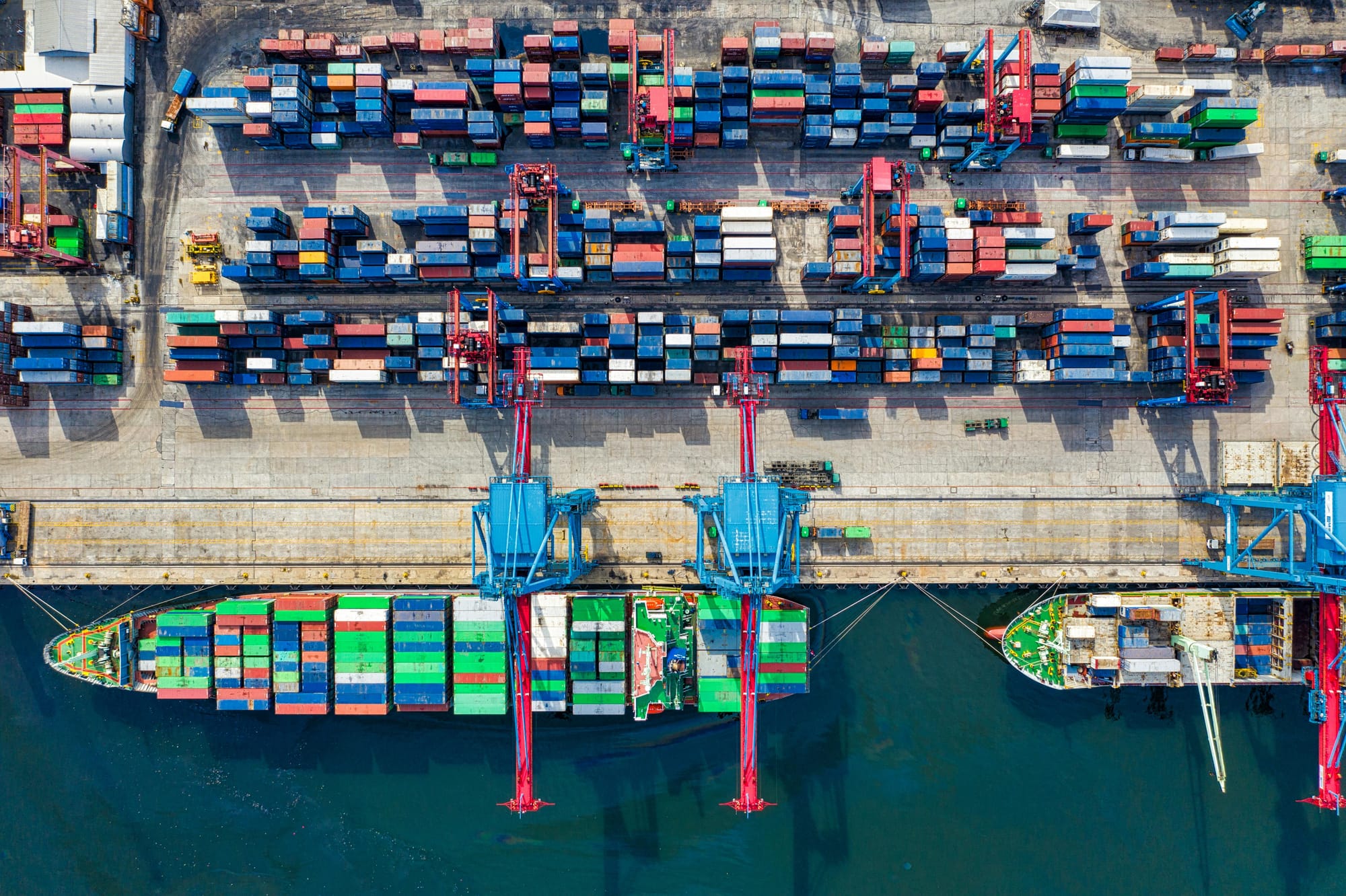

- 🚢 Time to plan prospective shipments and investments without the threat of sudden cost spikes.

- 📊 A public signal to global markets that both sides are committed to talks over escalation, boosting investor confidence worldwide.

⚠️ But the clock is ticking. If talks collapse after 90 days, tariffs could snap back fast.

What does this mean for law firms?

🏙️ Corporate teams could see previously stalled cross-border deals coming back to life. An increase in M&A’s, Equity investments and Asset purchases. This means an increase in work for:

- 🤝 Merger & Acquisition lawyers – Running due diligence checks on the target company, drafting and negotiating sale agreements, and coordinating with overseas solicitors.

- 💷 Finance Lawyers – Structuring how deals are financed (loans, bonds, private placements) and ensuring funding conditions are met.

- 🏗️ Private Equity Lawyers - Advising investors on structuring deals, exit strategies, and compliance with both domestic and foreign investment laws.

🛒 Commercial teams will often work alongside corporate teams on these cross-border deals. Their job is to ensure businesses continue to run smoothly post-completion. This also means more work for:

- 📜 Commercial contracts lawyers – Reviewing and amending supply, distribution, and manufacturing contracts to ensure they are “tariff-proof”, along with allocating risks to avoid future disputes.

It’s essentially answering the question: “If X goes wrong, who has to deal with it (and pay for it)?”

- 💻 Technology & IT lawyers – Updating licensing and service contracts for cross-border technology transfers, while also ensuring compliance with international export control and data protection laws.

⚖️ Regulatory teams support both corporate and commercial work by ensuring every aspect of the transaction complies with the relevant trade, competition, and industry rules. Without their sign-off, a deal can’t legally close or operate. In terms of the 90-day pause, this will generate more work for:

- 🌎 International trade lawyers – Advising on global trade rules, customs requirements, and bilateral trade agreements to keep goods flowing smoothly.

- 📉 Competition/antitrust lawyers – Assessing whether the deal requires merger clearance from regulators in one or more jurisdictions and guide the filing process.

- 🧬 Sector-specific regulatory lawyers – For industries like pharmaceuticals, energy, telecoms, or aviation, ensure licensing and operational approvals remain valid post-transaction.

🔗 How the Teams Overlap

In a cross-border deal, these teams rarely work in isolation:

- 🏙️ Corporate lawyers structure and negotiate the transaction.

- 🛒 Commercial lawyers make sure day-to-day business contracts will still function after the deal.

- ⚖️ Regulatory lawyers confirm everything complies with trade laws, competition rules, and industry-specific regulations.

💬 Without all three working together, deals risk delays, added costs and even collapse.What’s the takeaway for law students?

- ©️ Transactional IP lawyers – Transferring or licensing intellectual property rights tied to deals and protecting brand assets (Trademarks, design rights, copyrights) across various jurisdictions.

How UK & US Firms May Be Impacted?

📌 3 UK Firms Likely to See an Impact

- Freshfields Bruckhaus Deringer – May help speed up cross-border mergers and joint ventures in industries like manufacturing and tech, Additionally, handling the regulatory approvals needed in multiple jurisdictions.

- Baker McKenzie - Likely advising global manufacturers and exporters on ‘tariff-proof’ supply chain contracts, so they work even if tariffs return.

- Herbert Smith Freehills - Could work on major deals and disputes in sectors such as energy, resources, and infrastructure that are affected by changes in trade rules.

📌 3 US Firms Likely to See an Impact

- Sidley Austin – Advising on global trade rules, export restrictions, and product classifications to make sure goods can legally move between China and the US.

- Latham & Watkins - Handling high-value cross-border M&As, often partnering with UK counsel on multi-jurisdiction transactions.

- Holland & Knight - Through its “Tariff Task Force,” they can help clients assess supply chain vulnerabilities and secure customs rulings before the pause ends.

🎯Student Takeaway:

The 90-day tariff pause is a live example of how a single geopolitical decision can trigger work across corporate, commercial, and regulatory teams - often with clear deadlines. Understanding how these teams collaborate, and the types of work involved, will help you connect real-world news to the work law firms actually do.